How Much Money Is Spent On Welfare Each Year By The Federal Government?

Welfare spending generally aims to improve the social and economical wellbeing of the population. It is singled-out from health spending in that it focuses on measures such every bit income support and social and economical employment-related programs and services (for instance, unemployment relief and family unit and relationships services).

See the Australian Constitute of Wellness and Welfare's Health expenditure Australia series for more information on health spending.

Both the Australian Government and the state and territory governments contribute to welfare spending, as exercise non-government organisations and individuals. The Australian Government primarily contributes through greenbacks payments relating to its areas of responsibility, equally defined in the Australian Constitution (which include family unit allowances, unemployment benefits and pensions); information technology as well contributes to certain welfare services. The states and territories focus more than on providing welfare services.

Data on welfare spending that is funded by non-government sources (for example, where a welfare service is funded past donations or fees rather than through government funding) are non readily available in Australia and are not included here.

See Philanthropy and charitable giving for some data on non-government donations.

Government welfare expenditure in Commonwealth of australia

In 2019–20, government spending on welfare services and payments was $195.7 billion. The Australian Government funded the bulk of this amount (88% or $171.5 billion), with the remaining 12% funded by country and territory governments.

About welfare expenditure data

Where possible, welfare spending estimates accept been adult for consistency with the Australian Wellness and Welfare's Welfare Expenditure Australia series of publications. This ensures tendency data are consistent.

Constant prices and 'real terms'

Spending is reported in constant prices (that is, adjusted for inflation) except where noted. The use of constant price estimates indicates what the equivalent spending would have been had 2019–20 prices applied in all years, as information technology removes the inflation consequence. The phrase 'real terms' is also used to describe spending in constant prices. On this page:

- abiding price estimates for spending were derived using deflators produced past the Australian Bureau of Statistics

- the Consumer Cost Alphabetize was used for greenbacks payments, and the government final consumption expenditure (implicit price deflator) for welfare services and tax concessions.

Comparability with other welfare spending estimates

To maintain historical comparability, the Youth Allowance (Students and Other), Austudy and the Ancient and Torres Strait Islander Written report Assistance Scheme (ABSTUDY) are not included in the welfare spending estimates presented on this page. Therefore, these estimates are not comparable with figures reported elsewhere (such as in the Treasury Final Budget Consequence).

State and territory welfare expenditure

The most recent welfare expenditure information available for state and territory governments are for the 2015–sixteen financial year, as published in the 2017 Ethnic expenditure report (Productivity Commission 2017), which includes data for both indigenous and non-Indigenous welfare service expenditure. Land and territory data were estimated for 2016–17 to 2019–20 using available trend information from the Ethnic expenditure report and from Government finance statistics (GFS) 2019–20, in which the Classification of the Functions of Government – Commonwealth of australia (COFOG-A) was used (ABS 2015, 2021b). In previous reports, the GFS was based on the older Government Purpose Classification (ABS 2005).

Hence, the estimated time series data on this page are not fully comparable with data published previously. Any additional spending on welfare services by the states and territories related to either the 2019–20 bushfires or the coronavirus 2019 (COVID-19) are also not visible in these data.

Sources of data

Data are sourced from the welfare expenditure dataset of the Australian Constitute of Health and Welfare, which is, in turn, sourced from publicly available information from:

- the Australian Agency of Statistics

- the departments of Education, Skills and Employment; Wellness; Prime number Minister and Chiffonier (PM&C); Social Services; the Treasury; Veterans' Affairs

- the National Disability Insurance Agency (NDIA)

- the Productivity Commission.

Information for 2018–xix and 2019–xx are extracted from the corresponding reports of these organisations (ABS 2021b; Department of Education, Skills and Employment 2020, 2021; Section of Health 2020, 2021; Section of the Treasury 2021; Department of Social Services 2020b, 2021b; Department of Veterans' Affairs 2020, 2021; NDIS 2021; PM&C 2020, 2021; Productivity Committee 2021).

Trends in welfare expenditure

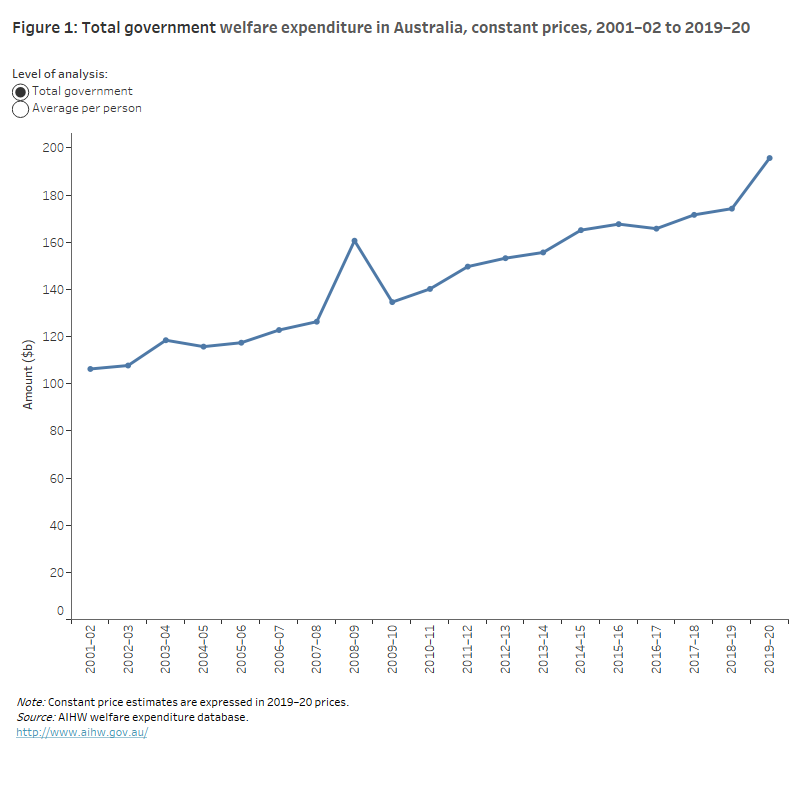

In 2019–20, the Australian and state and territory governments spent $195.vii billion on welfare. In real terms (that is, adapted for inflation), this represented a 12% growth in spending from 2018–xix – an additional $21.five billion. This real growth was much higher than the average growth over the menses from 2001–02 to 2019–twenty (3.5% per annum) (Figure ane). The main driver of this loftier growth rate in 2019–xx was the economical measures the Australian Government implemented from March 2020 in response to the coronavirus 2019 (COVID-19) pandemic.

See COVID-19 economical response measures.

Before 2019–20, and before these COVID-19 measures, welfare spending in Australia had generally grown at a similar pace to population growth, with real spending fluctuating at around $6,985 per person since 2014–15. In 2019–20, real spending increased by around 11% to $vii,668 per person.

This welfare spending relates to spending beyond the unabridged population and not spending per eligible person in particular programs or spending per benefit recipient. This more detailed analysis is not included on this folio.

This line chart shows that total government welfare expenditure increased steadily from $106.3 billion in 2000–01 to $195.7 billion in 2019–xx. Per person regime welfare expenditure increased from $5,481 in 2000–01 to $seven.668 in 2019–20. Both full regime welfare expenditure and per person government welfare expenditure rose sharply during the Global Fiscal Crisis (GFC) in 2008–09.

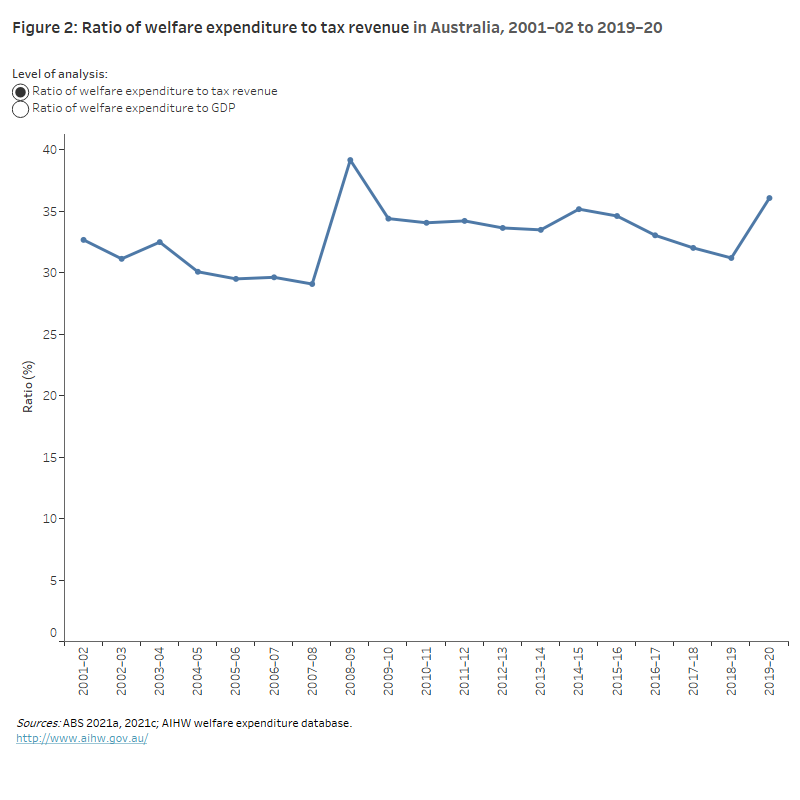

This line graph shows ratios of welfare expenditure to tax revenue and GDP for the menses 2001–02 to 2019–xx. The average ratio of welfare expenditure to revenue enhancement revenue was 33 percent over the period but peaked during the GFC in 2008–09. Similarly, the authorities welfare expenditure to Gross domestic product ratio was stable though it rose sharply to 10.3% in 2008–09.

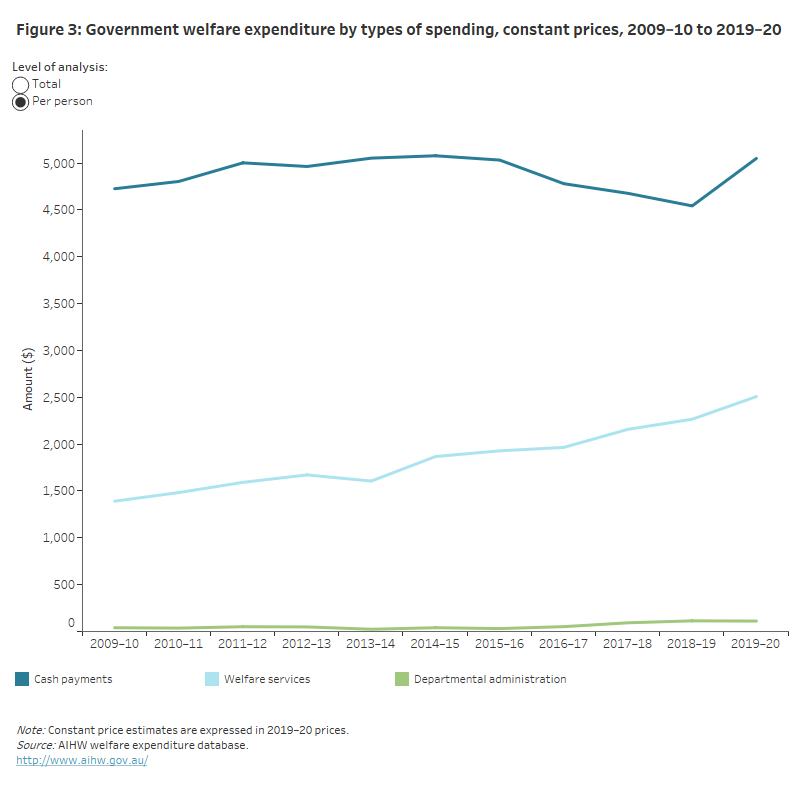

This line graph shows that cash payments has been larger than welfare services, followed by departmental administration costs over the whole menses. Cash payments increased steadily over the period 2009–x to 2015–16 before decreased in the adjacent three years, so rose sharply in 2019–20. Over the same period, welfare services increased steadily most of the years except a slight decrease in 2013–14.

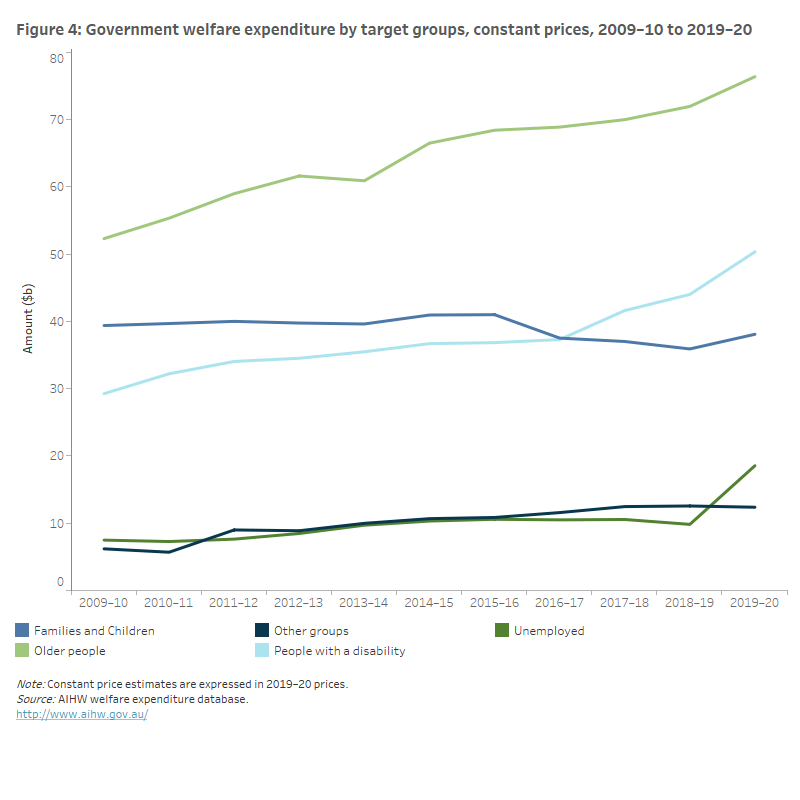

This line graph showing authorities welfare expenditure by targe group over the period 2009–ten to 2019–20. Over the period, the welfare expenditure for older people has been larger than for people with a inability, families and children, followed by unemployed people and other welfare groups. The welfare spending on unemployed people, people with a disability, older people and families and children increased in 2019–twenty while the expenditure on other groups decreased over the same period.

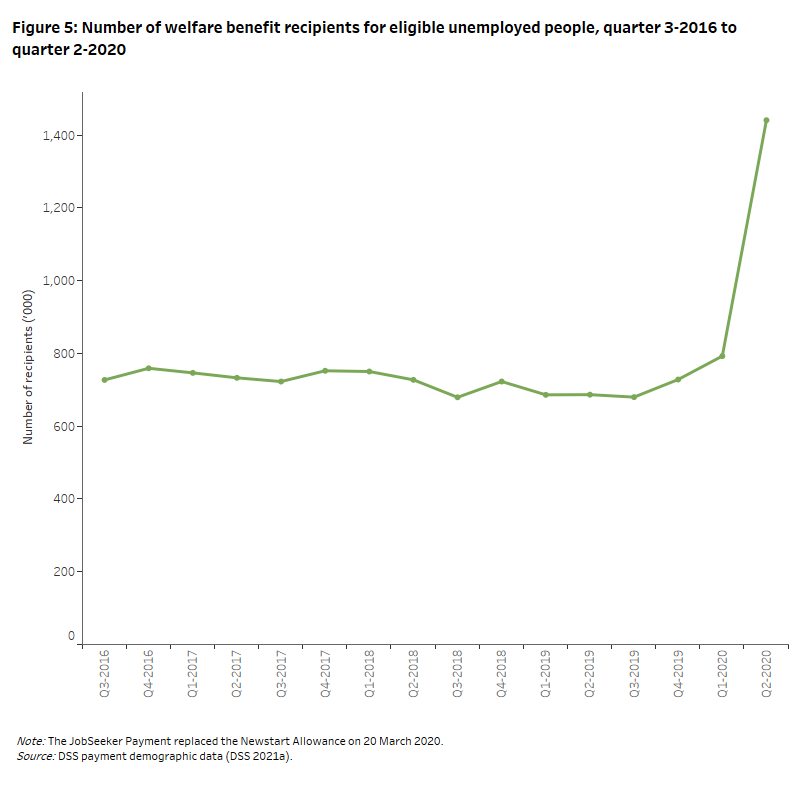

This line graph shows the number of welfare benefit recipients for eligible unemployed people over the menstruation Quarter 3-2016 to Quarter 2-2020. The recipient number was quite stable over the menstruation up to the third quarter in the financial year 2019–twenty at about 700,000. Then the number of welfare do good recipients peaked in the fourth quarter in this year following the touch on of the COVID-19 pandemic.

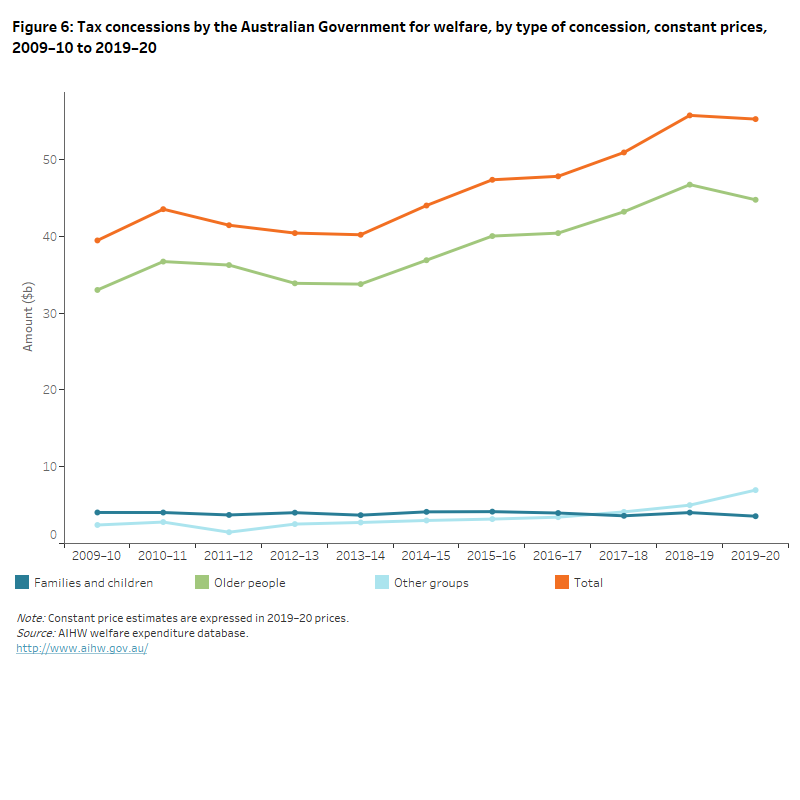

This line graph shows tax concessions by the Australian governments for welfare by target groups in the flow 2009–10 to 2019–20 in abiding prices. Over the period, the tax concessions for older people has been larger than those for families and children, followed by those for other groups. The tax concessions for older people was quite stable over the menstruum 2009–10 to 2013–14 before increased steadily in the next five years, then decreased in 2019–xx. The tax concessions for families and children have remained stable over the period.

This horizontal bar chart shows welfare expenditure as a proportion of Gross domestic product beyond OECD countries in 2017. Finland had the highest proportion (22%), followed by France and Italian republic (21%). United mexican states ranked the lowest (about four%). Commonwealth of australia ranked below the OECD median.

Source: https://www.aihw.gov.au/reports/australias-welfare/welfare-expenditure

Posted by: stephensyough1967.blogspot.com

0 Response to "How Much Money Is Spent On Welfare Each Year By The Federal Government?"

Post a Comment